As the financial landscape is becoming more and more volatile, portfolio diversification becomes more and more critical. Whether you are a beginner or an experienced investor, understanding what diversification is and why it matters today can help you positively impact your finances. In a time when inflation is increasing, the world is unpredictable, and technological advancement is incredibly rapid, diversification is not an option but an obligation if you want to build wealth with less risk.

This guide will discuss portfolio diversification, its benefits, how to diversify your investments, and an analysis of fundamental asset allocation strategies that allow investors to protect and grow their capital in today's economy.

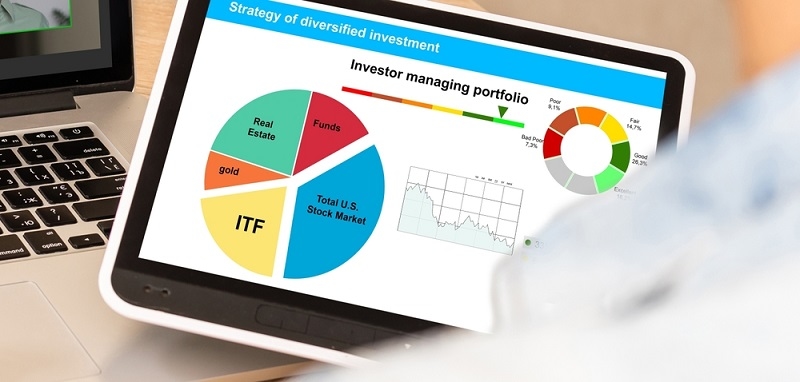

Portfolio diversification is spreading capital across multiple assets, sectors, and geographies to reduce exposure to any risk. The basic idea is simple: don't put all your eggs in one basket.

When diversifying, the goal will be to minimize the effect of one lackluster investment on your overall portfolio. For example, if you only own shares in tech stocks and the tech stocks suffer a market collapse, your whole portfolio is sunk. However, if you also owned bonds, commodities, or real estate, gains in one asset type may offset losses in another.

Global markets are more interconnected and sensitive to events worldwide than ever. Geopolitical tensions, inflation data, interest rate changes, and tweets create dizzying market swings. Diversification allows you to manage that volatility.

Economic trends change constantly, from post-pandemic recovery to wildly swinging oil prices and disruptions from AI technology. The markets continuously change. A diversified portfolio protects you from sudden downturns in any sector or region.

Risk management investing is the heart of portfolio diversification. While you will never eliminate risk—there are too many variables—investors can deploy a strategy to balance risk across assets with various return profiles and levels of volatility.

Investing is a marathon, not a sprint. Diversifying your investments aims to help you accumulate wealth over time by minimizing catastrophic declines, allowing your investment portfolio more opportunities to achieve growth over the long term.

Investing in different industries or types of assets reduces the likelihood of a total loss. For example, gold or bonds may gain if stocks fall in value.

A well-diversified portfolio may include stocks, bonds, REITs, and international investments. It smooths out annual performance, minimizing dramatic ups and downs.

As investors, diversification exposes you to more opportunities. Growth potentials and risks differ for technologies, real estate, emerging markets, energy, etc.

Diversified portfolios can be constructed to fit specific timelines and risk tolerance levels, regardless of whether the investments were made for retirement, to purchase a home, or to invest in education for your children.

Don’t rely solely on stocks. Include other classes such as

Investing globally spreads out geopolitical and currency risk. For example, you might invest:

This asset allocation strategy ensures you are not too exposed to one region’s downturn.

Holding stocks across various sectors like tech, healthcare, consumer goods, and energy ensures that poor performance in one sector doesn't tank your entire portfolio.

Investing smaller amounts over time instead of a lump sum helps average the cost per share and reduces the risk of poor timing.

Balance between:

Each category reacts differently to market changes and economic cycles.

Let’s explore some tried-and-true methods of building a diversified portfolio based on different investment goals and risk tolerances.

| Asset Class | Allocation (%) |

| Bonds | 60 |

| Stocks | 25 |

| REITs | 10 |

| Cash | 5 |

Ideal for: retirees or investors with a low risk appetite.

Benefits: High stability, predictable income.

| Asset Class | Allocation (%) |

| Stocks | 50 |

| Bonds | 30 |

| REITs | 10 |

| Commodities | 5 |

| Cash | 5 |

Ideal for: Long-term investors seeking a mix of growth and stability.

Benefits: Balanced risk and return potential.

| Asset Class | Allocation (%) |

| Stocks | 70 |

| International Stocks | 15 |

| Alternative Assets | 10 |

| Cash | 5 |

Ideal for: Younger investors with a long investment horizon.

Benefits: Higher growth potential, greater volatility.

Let’s say you have $100,000 to invest and choose a balanced portfolio strategy:

If U.S. stocks drop by 10%, you’d lose $5,000 in that portion. But your bonds and gold may gain or remain stable, softening the overall blow and giving your portfolio time to recover.

This diversification benefit demonstrates how a smart allocation shields you from sudden market shocks.

Modern tools and platforms have made it easier than ever to diversify:

Whether you use a financial advisor or DIY tools, tech can simplify how to diversify investments and maintain optimal asset allocation.

When markets drop, it’s natural to panic. A diversified portfolio helps investors stay calm and invested. Instead of seeing your entire net worth evaporate with one market sector, you’ll notice more minor fluctuations, which helps maintain a long-term outlook.

This behavioral advantage—emotional discipline—is just as critical as financial planning.

Understanding asset allocation and its importance is key for creating a resilient and growth-centric investment strategy. Diversification enables you to navigate the storm, take advantage of offers, and sleep better at night, whether investing for retirement, financial independence, or your children’s future.

As the world remains uncertain, one of the most straightforward and reliable wealth growth strategies is spreading your risk (and using a diversified portfolio as a tool) across types of assets, geographies, and sectors.

Please take the time to review your portfolio. Are you arranged in a diversified manner? If not, begin today! A diversified portfolio is not a complex process; it is developing a balanced portfolio that controls the ongoing risk to achieve a long-term successful outcome.

This content was created by AI